How did the TCJA change the standard deduction and itemized deductions?

The Tax Cuts and Jobs Act nearly doubled the standard deduction and eliminated or restricted many itemized deductions in 2018 through 2025. It also eliminated the “Pease” limitation on itemized deductions for those years.

The Tax Cuts and Jobs Act (TCJA) increased the standard deduction from $6,500 to $12,000 for individual filers, from $13,000 to $24,000 for joint returns, and from $9,550 to $18,000 for heads of household between 2017 and 2018.

As before, the amounts are indexed annually for inflation. The TCJA changed the measure used for inflation indexing from the consumer price index for all urban consumers (CPI-U) to the chained CPI-U—a more accurate measure but one that results in a smaller upward adjustment each year. The standard deduction amount for tax year 2023 (filed in 2024) is $13,850 for single filers, $27,700 for married couples, and $20,800 for heads of household. The additional deduction for single filers or heads of household who are either age 65 or over or blind is $1,850 ($3,700 if the person is both age 65 or over and blind).

The TCJA eliminated or restricted many itemized deductions for 2018 through 2025. This, together with a higher standard deduction, reduced the number of taxpayers who itemize deductions. In 2017, 31 percent of all individual income tax returns had itemized deductions, compared with just 9 percent in 2020.

State and local taxes (SALT). Taxpayers can still deduct state and local real estate, personal property, and either income or sales taxes in tax years after 2017, but the TCJA capped the total SALT deduction at $10,000 for tax years 2018 through 2025.

Mortgage interest. The TCJA limited the deduction to the home mortgage interest on the first $750,000 of mortgage debt (reduced from the pre-TCJA limit of $1 million of mortgage debt) for mortgage loans taken out after December 15, 2017. Homeowners may no longer deduct interest paid on home equity loans, which was allowed for loans up to $100,000 before the TCJA, unless the debt is used to buy, build, or substantially improve the taxpayer’s home that secures the loan. Homeowners may still deduct mortgage interest on their primary residence and a second home.

Charitable contributions. The TCJA increased the limit on deductions for charitable contributions from 50 percent to 60 percent of adjusted gross income (AGI).

Medical expenses. Under the TCJA, taxpayers can deduct unreimbursed medical expenses that exceed 7.5 percent of their AGI. The floor was 10 percent of AGI prior to the TCJA.

Other itemized deductions. The TCJA eliminated deductions for unreimbursed employee expenses, tax preparation fees, and other miscellaneous deductions. It also eliminated the deduction for theft and personal casualty losses, although taxpayers can still claim a deduction for certain casualty losses occurring in federally declared disaster areas.

Limitation on itemized deductions. The TCJA eliminated the “Pease” limitation on itemized deductions. Before TCJA, taxpayers reduced their itemized deductions by 3 percent of every dollar of taxable income above certain thresholds. The total reduction was capped at 80 percent of the total value of itemized deductions.

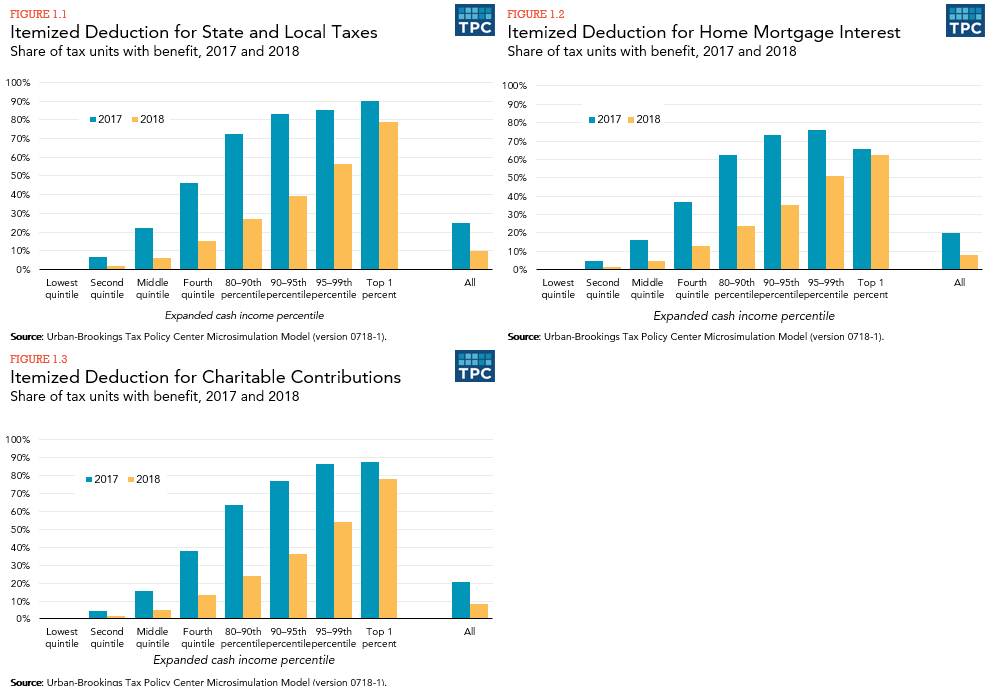

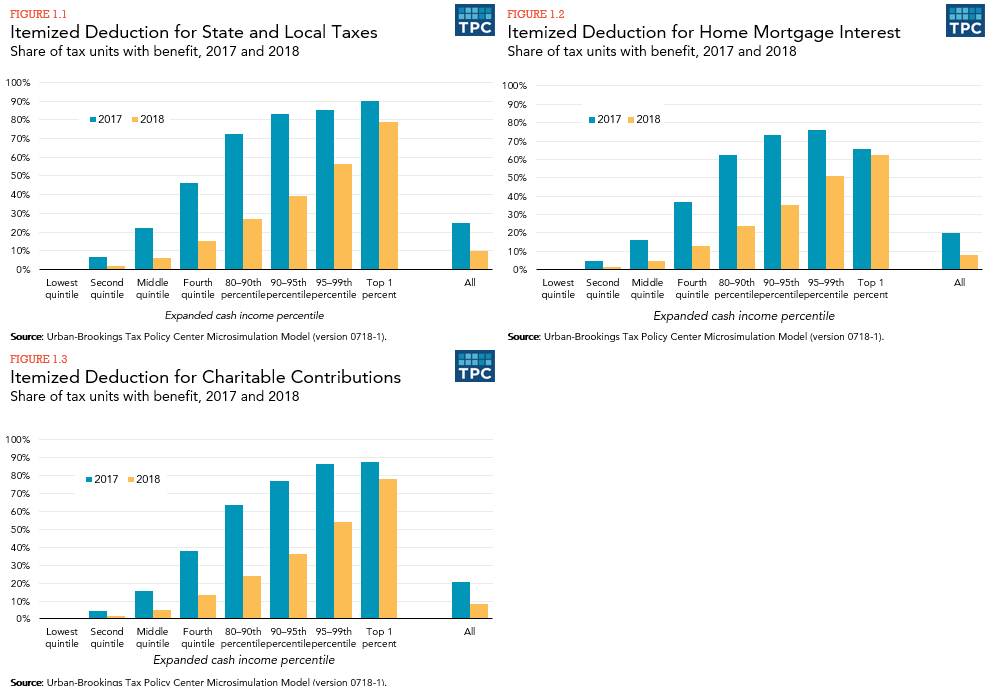

TCJA significantly decreased the number of taxpayers claiming itemized deductions and the average tax saving from claiming them. The following figures compare the estimated percentage of taxpayers with a tax benefit from the three major itemized deductions—state and local taxes, mortgage interest, and charitable contributions—and the tax saving from claiming them in 2017 and 2018, before and after TCJA. The tax benefit is measured as the reduction in tax liability from the deduction, accounting for the applicable tax rates in each year, the effects of the alternative minimum tax (which disallows the SALT deduction), and the overall limit on itemized deductions (the “Pease” limit) that was in place in 2017 but eliminated for future years by TCJA.

The percentage of taxpayers with a tax benefit from the SALT deduction fell from about 25 percent in 2017 to 10 percent in 2018, from 20 percent to 8 percent for the mortgage interest deduction, and from 21 percent to 9 percent for the charitable contributions deduction (figure 1).

The decline in the tax benefit from the deductions is even more dramatic. Measured as a percentage of after-tax income, the tax saving from the SALT deduction in 2018 was about one-quarter of what it was in 2017 overall. For taxpayers in the top 1 percent of the income distribution, the tax saving in 2018 was about one-tenth of the tax saving in 2017 (figure 2). The distribution of the tax benefits from the SALT, mortgage interest, and charitable deductions in 2019 are similar to those in 2018.